Not known Details About Offshore Banking

Table of ContentsEverything about Offshore BankingThe Facts About Offshore Banking RevealedThe smart Trick of Offshore Banking That Nobody is DiscussingTop Guidelines Of Offshore Banking9 Easy Facts About Offshore Banking Explained

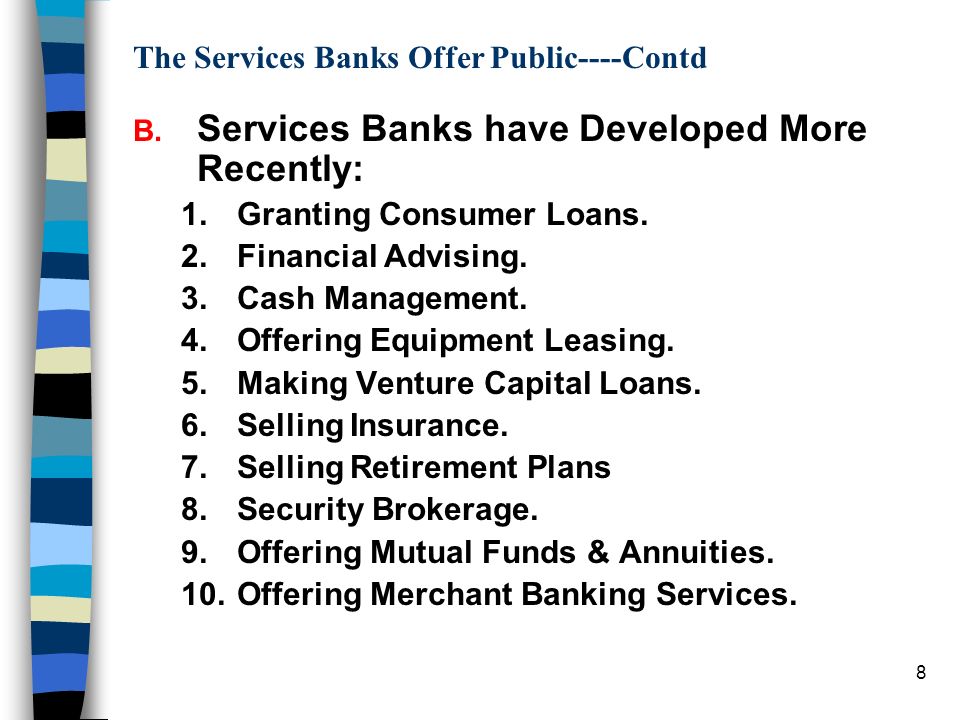

Some usual kinds of lendings that banks provide include: If your present economic institution does not use the services pointed out above, you might not be obtaining the very best financial service possible. At First Bank, we are devoted to assisting our customers get the most out of their cash. That is why we provide various kinds of financial services to satisfy a selection of requirements.

Pay expenses, rent out or cover up, acquire transport tickets as well as even more in 24,000 UK places

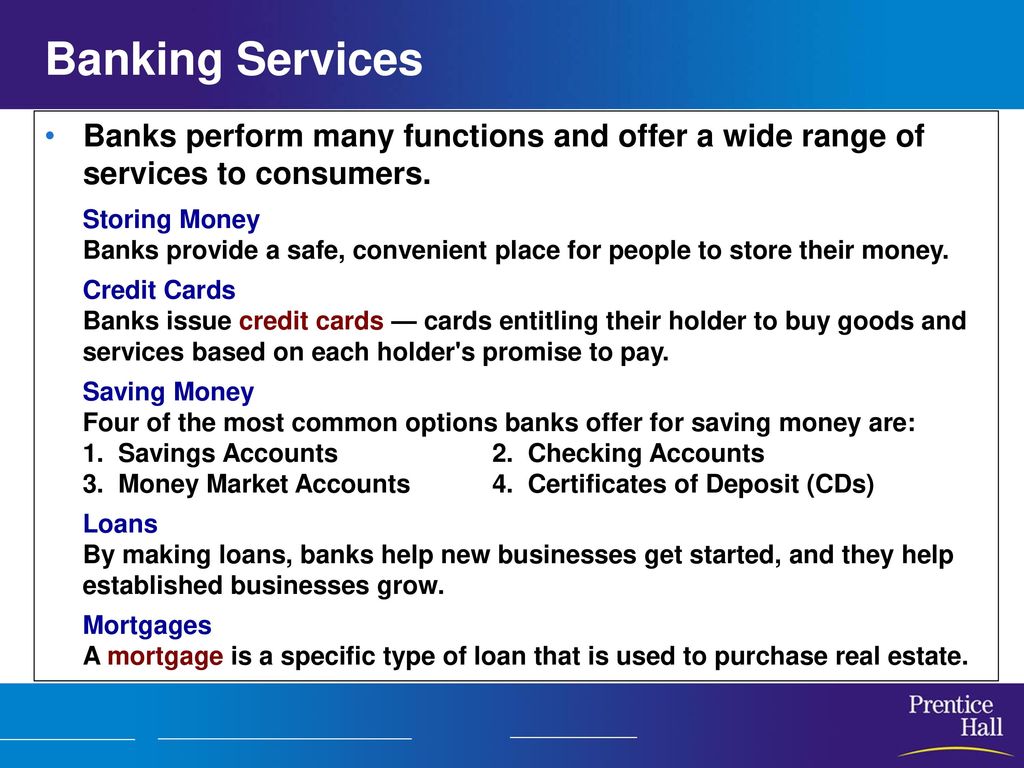

That's because there are numerous kinds of financial institutions and also economic organizations. By recognizing the different types of financial institutions and also their functions, you'll have a better sense of why they're crucial and also just how they play a duty in the economic climate.

The Ultimate Guide To Offshore Banking

In regards to banks, the main financial institution is the head boss. Reserve banks manage the cash supply in a single country or a series of countries. They supervise commercial financial institutions, set passion rates and control the flow of currency. Reserve banks additionally apply a federal government's monetary policy objectives, whether that entails combating deflation or keeping rates from changing.

Retail financial institutions can be conventional, brick-and-mortar brands that consumers can access in-person, online or via their mobile phones. Others just make their tools and also accounts offered online or via mobile apps. There are some kinds of industrial financial institutions that assist daily customers, business financial institutions tend to concentrate on supporting services.

The shadow banking system includes monetary groups that aren't bound by the same stringent rules as well as laws that financial institutions need to adhere to. Just like the typical managed banks, shadow financial institutions handle credit rating as well as different type of assets. They get their financing by obtaining it, linking with financiers or making their own funds instead of making use of cash released by the central financial institution.

Cooperatives can be either retail banks or commercial banks. What distinguishes them from other entities in the monetary system is the truth that they're normally neighborhood or community-based organizations whose members assist establish exactly how business is operated. They're run democratically and they use financings and checking accounts, to name a few things.

How Offshore Banking can Save You Time, Stress, and Money.

Like banks, credit score unions provide car loans, provide savings as well as checking accounts as well as satisfy other economic requirements for customers as well as companies. The difference is that financial institutions are for-profit companies while credit unions are not - offshore banking.

Participants benefited from see the S&L's services and earned more interest from their financial savings than they might at business financial institutions (offshore banking). Not all financial institutions offer the exact same function.

In time, they have actually been widely utilized by both advanced reserve managers as well as by those with even more straightforward demands. Sight/notice accounts as well as dealt with and also drifting rate down payments Fixed-term down payments, additionally denominated in a basket of money such as the SDR Flexible quantities as well as maturations An attractive investment widely used by reserve supervisors looking for additional yield as well as exceptional credit scores quality.

This paper presents an approach that financial institutions can utilize to assist "unbanked" householdsthose who do not have accounts at deposit institutionsto sign up with the mainstream financial system. The primary objective of the technique is to assist these families develop savings as well as boost their credit-risk profiles in order to lower their cost of settlement services, get rid of a typical source of individual stress, and get to lower-cost resources of credit history.

The smart Trick of Offshore Banking That Nobody is Talking About

Second, it will provide them a set of solutions better made to satisfy their needs. Third, it is much better structured to aid the unbanked ended up being typical bank clients. Fourth, it is also likely to be a lot more lucrative for banks, making them a lot more ready to implement it. Numerous studies have actually analyzed the socioeconomic qualities of the around ten million families that do not have savings account.

They have no prompt requirement for credit score or do not find that their unbanked status omits them from the credit that they do require. Payment services are additionally not bothersome for find more a selection of reasons. Numerous get and also make couple of non-cash payments. Others money paychecks totally free at a fitting deposit organization, grocery shop, or various other organization.

A lot of banks Source in urban locations won't pay incomes for people who do not have an account at the financial institution or who do not have an account with sufficient funds in the account to cover the check. It can be fairly pricey for someone living from income to paycheck to open a bank account, even one with a reduced minimum-balance demand.

Each bounced check can set you back the account holder $40 or more given that both the check-writer's bank as well as the seller who accepted the check frequently penalize costs. It is likewise pricey as well as troublesome for financial institution consumers without examining accounts to make long-distance repayments. Mostly all banks charge at the very least $1 for money orders, and also numerous fee as much as $3.

More About Offshore Banking

As kept in mind in the intro, this paper says that one of the most effective and also cost-efficient methods to bring the unbanked right into the banking system must involve 5 measures. Below is an explanation of each of those measures and also their reasonings. The very first step in the proposed technique gets in touch with taking part financial institutions to open customized branches that provide the full variety of business check-cashing solutions along with common consumer banking solutions.